Introduction to Dubai Homes

One of the reasons that you may travel to Dubai is to invest in the Dubai Homes and Real Estate market. You may wish to buy a Dubai home, buy-to-let, offices, or other buildings. I have worked in the real estate market here and even co-founded a real estate broker many years ago.

Having been in Dubai for 18 years, I have seen the Dubai real estate market transform. It has turned itself from a small city to the giant and sparkling metropolis that it is today. The vision laid down by the leadership has borne fruit with a vast range of properties. These range from 7-Star hotels to the tallest building in the world, and the tallest residential towers. Also, offshore islands, and vast communities servicing residents and commercial needs.

Like all free markets, Dubai real estate has seen its ups and downs subject to worldwide economic conditions. Supply and demand as well as proper access to financing options have been important issues. But over the long term, the growth has been undeniable as the Dubai government has expanded upon its strategic goals. They have made Dubai one of the favorite places in the world to live and work.

Let us dive in and see in more detail about the Dubai real estate market. Useful links which will give you up-to-date information are at the end of this article.

Table Of Contents

Understanding Dubai Real Estate

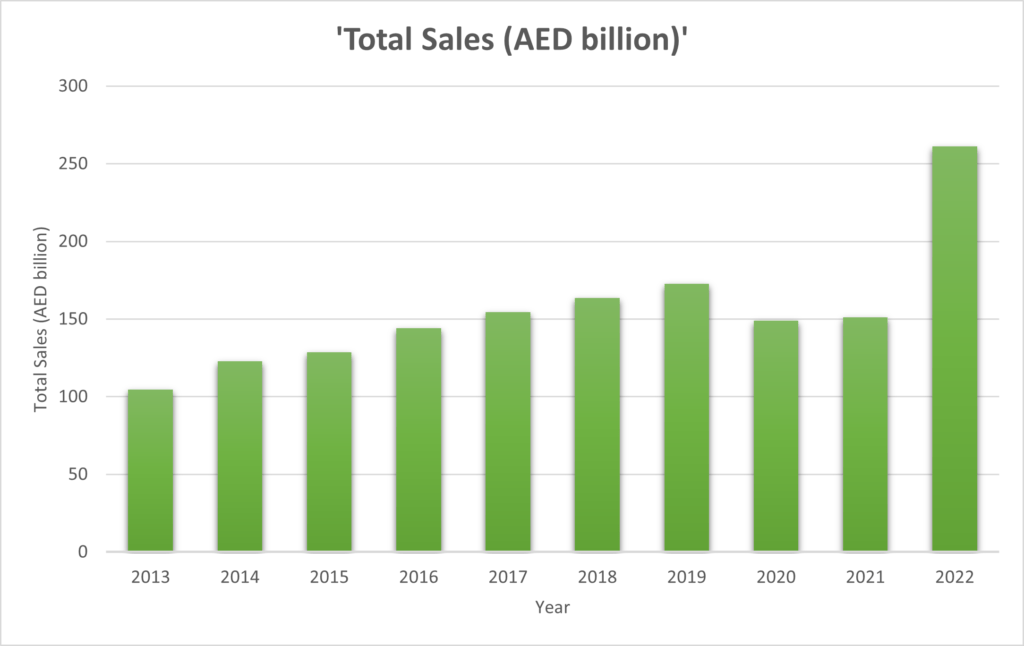

Dubai homes encompass a diverse range of residential properties, catering to different preferences and budgets. From luxurious waterfront villas to contemporary high-rise apartments, the city offers something for everyone. The allure of Dubai homes lies not only in their architectural grandeur but also in the city’s cosmopolitan lifestyle and business-friendly environment, making it an attractive destination for global investors and expatriates seeking a new home. The chart below shows the annual real estate transactions every year from 2013 to 2022.

Freehold and Leasehold Properties

Dubai operates under a unique property ownership system, with both freehold and leasehold options available to buyers. Freehold properties grant the owner full ownership of the property and the land it stands on, providing an enduring investment. On the other hand, leasehold properties offer ownership for a limited period, typically 99 years, where the land is leased from the government or private entities. Understanding the difference between these ownership types is crucial for prospective buyers looking to invest in Dubai homes.

Real Estate Regulatory Authority (RERA)

The Real Estate Regulatory Authority (RERA) plays a pivotal role in overseeing Dubai’s real estate market. Established to regulate and ensure transparency in the industry, RERA has introduced various initiatives to safeguard the interests of buyers and sellers. Its influence extends to monitoring project development, setting industry standards, and resolving disputes, instilling confidence in investors and enhancing overall market stability.

Dubai Land Department (DLD)

The Dubai Land Department (DLD) is the government entity responsible for overseeing property registration and transactions. It plays a significant role in facilitating smooth and secure real estate dealings, handling title transfers, and maintaining a comprehensive database of property ownership. The DLD’s services are instrumental in providing a secure environment for property transactions and promoting investor trust.

How to Purchase a Dubai Home

Purchasing a property in Dubai involves a series of steps, legal procedures, and documentation. From selecting the right property to obtaining a no-objection certificate (NOC) from the developer and registering the transfer with the DLD, the process can be intricate. Prospective buyers must understand the requirements and costs associated with the purchase to make an informed decision.

There is a contract exchange known as the ‘Tejari Contract’ which outlines the details of the property and the conditions of the sale. Properties can be off-plan (to be constructed), or ready to move in (the secondary market). All contracts are registered at the Dubai Land department who facilitates the legal processes in completing the purchase.

How to Sell a Dubai Home

Selling a property in Dubai requires strategic planning, marketing, and knowledge of market dynamics. Property owners need to prepare their homes for sale, price them competitively, and enlist the services of a reputable real estate broker to facilitate the process. Understanding the intricacies of the selling process can significantly impact the success of the transaction. As above the Dubai Land Department facilitates the legal contracts and processes to confirm the sale.

Prominent Property Developers

Dubai’s real estate landscape is dotted with visionary property developers known for their iconic projects. From creating awe-inspiring architectural marvels to delivering sustainable communities, these developers have transformed Dubai into a global real estate hotspot. We will explore some of the prominent names behind the city’s most celebrated developments.

| Rank | Developer | Market Cap (USD) |

|---|---|---|

| 1 | Emaar Properties | 22.8 billion |

| 2 | Nakheel Properties | 18.4 billion |

| 3 | Dubai Properties | 11.2 billion |

| 4 | Meraas | 6.4 billion |

| 5 | Meydan | 4.8 billion |

| 6 | Sobha Realty | 3.2 billion |

| 7 | Deyaar | 2.4 billion |

| 8 | Omniyat | 1.6 billion |

| 9 | MAG Property Development | 1.2 billion |

| 10 | Azizi Developments | 1.0 billion |

- Data as of July 23, 2023.

Please note that this is just a snapshot of the top 10 real estate developers in Dubai. There are many other reputable developers in the city, and the market cap of a developer can fluctuate over time.

Role of Real Estate Brokers

Real estate brokers play a crucial role as intermediaries between buyers and sellers. With their in-depth market knowledge and negotiating skills, they assist both parties in achieving their objectives. However, choosing the right broker is essential, and we will discuss the factors to consider when selecting a real estate professional.

If you are renting/buying a property then you normally have to do so via a broker. Here is some general advice when dealing with them for properties.

- All genuine real estate brokers must hold a valid RERA broker card. Ask to see it and keep a copy. Also, ask to see their Emirates ID and keep a copy.

- The broker must be employed full-time with a registered RERA brokerage firm. Ask for a copy of the firm’s license.

- Never pay cash to a broker. Always go to their office, pay in cash if you wish, but get a receipt. Bank transfers and cheques are also acceptable. Post-dated cheques are used for future rent payments.

- Rental contracts are standardized and need to be signed by both parties before money is exchanged ideally.

- If you agree to rent a property after viewing then you will normally pay by post-dated cheque. It could be one cheque or multiple cheques for the year ahead. This is a negotiation between you and the broker.

- Get a copy of the Emirates ID or passport copy of the owner of the property and a copy of proof of ownership. This can be verified via the Dubai Land Department.

- You normally pay a deposit as well which is refundable upon leaving. Take photos of your new home as a record of its condition.

The above are general guidelines and not legal advice. You can discuss with RERA or take legal representation which is always the best advice.

Once a rental agreement has been signed then it must be registered on the ‘Ejari’ system. This allows the new tenant to connect electricity, water and telecoms services. It also provides legal proof that of the rental contract.

Laws and Regulations in Dubai Real Estate

The Dubai real estate market operates under a robust legal framework, protecting the rights of all stakeholders. From property registration and escrow accounts to tenant and landlord regulations, adhering to the legal requirements is paramount for a smooth and trouble-free property transaction. This is facilitated by RERA and the Dubai Land Department as mentioned elsewhere in this article.

The following table outlines some of the major laws within the Dubai real estate market:

| Law | Description |

|---|---|

| Law No. 16 of 2007 – Real Estate Regulatory Agency Law (RERA Law) | – Established the Real Estate Regulatory Agency (RERA) and defined its functions and responsibilities as the regulatory authority for the real estate sector in Dubai. |

| – RERA is responsible for licensing and regulating real estate developers, brokers, and other professionals, as well as overseeing property development, escrow accounts, and market practices. | |

| Law No. 13 of 2008 – Interim Property Register Law | – Introduced the Interim Property Register (IPR), an electronic system that records real estate transactions in Dubai. |

| – The IPR aims to provide a secure and transparent database of property ownership and transactions, enhancing the efficiency of real estate processes. | |

| Law No. 7 of 2006 – Real Property Registration Law | – Governs the registration of real estate transactions in Dubai. |

| – Outlines the procedures and requirements for registering property sales, leases, mortgages, and other transactions with the Dubai Land Department (DLD). | |

| Law No. 9 of 2009 – Dubai International Financial Centre (DIFC) Law No. 5 of 2009 – Real Property Law | – Pertains specifically to real estate transactions within the Dubai International Financial Centre, a financial free zone in Dubai. |

| – Provides a separate legal framework for property ownership, leasing, and registration within the DIFC. | |

| Law No. 13 of 2008 – Escrow Accounts Law | – Mandates that developers of off-plan projects must open escrow accounts for these developments. |

| – Ensures that buyers’ funds are protected and used solely for the development of the specific project, reducing the risk of financial losses. | |

| Law No. 26 of 2007 – Rent Law | – Governs the rental market in Dubai and regulates the relationship between landlords and tenants. |

| – Outlines the rights and obligations of both parties, rental increases, eviction procedures, and dispute resolution mechanisms. | |

| Law No. 9 of 2006 – Dubai International Financial Centre (DIFC) Law No. 7 of 2005 – Real Property Regulations | – Applies to real estate transactions within the Dubai International Financial Centre (DIFC). |

| – Sets out the regulations for property ownership, leasing, and registration within the DIFC jurisdiction. | |

| Decree No. 2 of 2011 – Strata Title Law | – Introduced the Strata Title Law, which governs the ownership and management of jointly owned properties in Dubai, such as apartments in a residential building or units in a commercial complex. |

| – Allows for individual ownership of units within a larger building and defines the rights and responsibilities of property owners and the owners’ association. | |

| Law No. 13 of 2008 – Real Estate Developer Regulation Law | – Regulates the activities of real estate developers in Dubai and establishes requirements and standards for project development. |

| – Aims to ensure that developers fulfill their commitments and deliver projects on time and to the specified quality standards. | |

| Law No. 21 of 2013 – Dubai Government Fees for Services Provided by the Dubai Land Department | – Specifies the fees associated with various services provided by the Dubai Land Department, such as property registration, title deeds, and other transactions. |

History of Real Estate Projects in Dubai

Dubai’s transformation from a modest trading post to a global metropolis is evident in its rich history of real estate projects. From the early developments that laid the foundation to the record-breaking skyscrapers that now define the city’s skyline, we will take a journey through time to explore the evolution of Dubai’s real estate landscape.

Dubai’s history of major real estate projects is a captivating tale of ambition, innovation, and visionary development. From humble beginnings as a fishing and trading town to becoming a global metropolis, Dubai’s real estate landscape has witnessed remarkable transformations over the years. Here are some key milestones in the history of major real estate projects in Dubai:

- Jumeirah – The Early Beginnings: In the 1960s and 1970s, the Jumeirah district saw the development of low-rise residential communities and beachfront villas. This laid the foundation for Dubai’s aspirations to become a desirable residential destination.

- Burj Al Arab – Icon of Luxury: Completed in 1999, the Burj Al Arab, the world’s first seven-star hotel, became an iconic symbol of Dubai’s extravagance and vision for architectural grandeur.

- Palm Jumeirah – The Artificial Archipelago: Developed in the early 2000s, the Palm Jumeirah is one of the world’s largest artificial islands. It comprises luxurious villas, apartments, hotels, and upscale retail and entertainment options.

- Dubai Marina – Urban Waterfront Living: Launched in the early 2000s, Dubai Marina became a prime location for luxury residential towers and a bustling waterfront community with a vibrant lifestyle.

- Downtown Dubai – Home of Burj Khalifa: Developed by Emaar Properties, Downtown Dubai is a world-renowned mixed-use development that houses the iconic Burj Khalifa, the tallest building in the world, as well as The Dubai Mall and The Dubai Fountain.

- Business Bay – Commercial Hub: Positioned as the central business district of Dubai, Business Bay is a major commercial and residential development, featuring skyscrapers, hotels, and residential towers.

- Jumeirah Beach Residence (JBR) – Beachfront Living: JBR is a popular beachfront development offering an array of residential towers, retail outlets, and dining options along the Arabian Gulf coastline.

- Dubai Sports City – Sporting Haven: Developed with sports enthusiasts in mind, Dubai Sports City is a sprawling community featuring stadiums, sports academies, residential properties, and entertainment facilities.

- Dubai International Financial Centre (DIFC) – Financial Hub: Established in 2004, DIFC became a prominent financial center hosting multinational corporations, financial institutions, and upscale residences.

- Meydan City – Equestrian Excellence: Home to the world-class Meydan Racecourse, Meydan City is a unique development centered around equestrian events and offering luxury villas and apartments.

- Dubai Creek Harbour – Dubai’s Future Icon: Under development, Dubai Creek Harbour will be home to the iconic Dubai Creek Tower, set to surpass the height of Burj Khalifa, and a vibrant mixed-use community.

- Expo 2020 Dubai – The Global Event: The Expo 2020 event site itself is a significant real estate development, showcasing innovative pavilions and infrastructures designed to host the world’s largest cultural event.

Trends and Innovations in Dubai Real Estate

The real estate market in Dubai is ever-evolving, driven by innovation and sustainability. From embracing smart technologies to incorporating eco-friendly practices, the industry is constantly adapting to meet the demands of the modern world. We will delve into the latest trends and innovations shaping Dubai’s real estate sector.

Challenges and Opportunities

While Dubai’s real estate market offers numerous opportunities, it is not without challenges. Economic fluctuations, changing market demands, and geopolitical factors can impact the industry. Understanding these challenges is vital for investors and stakeholders seeking to make informed decisions.

The Evolving Landscape of Dubai Property

As Dubai continues to grow and develop, so does the landscape of its homes and communities. Economic progress, urban planning, and technological advancements will shape the future of Dubai homes, catering to the evolving needs and preferences of its diverse population.

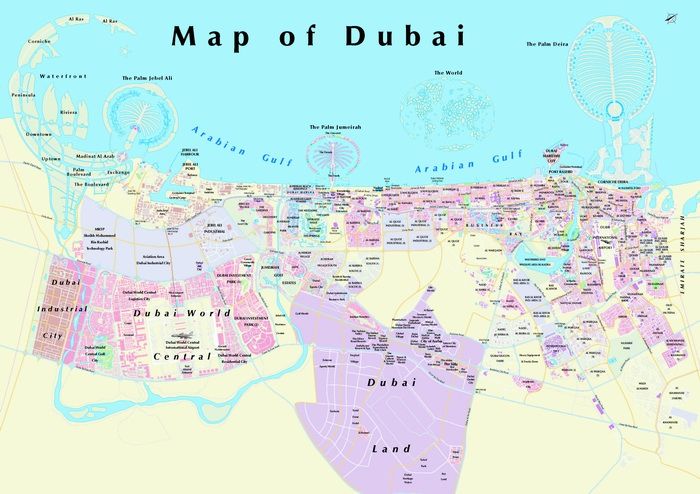

This map represents a vision for Dubai made many years ago. Part of it is complete and much is still under planning and development. There are always exciting things happening here.

Conclusion

Dubai’s real estate market is a vibrant tapestry of luxury, innovation, and opportunity. From breathtaking waterfront properties to futuristic smart communities, the city offers an exceptional array of Dubai homes for investors and residents alike. Understanding the intricacies of the market, its regulatory framework, and the role of key players is essential for anyone looking to participate in this dynamic and ever-evolving sector.

FAQ

- Is Dubai real estate open to foreign investors?

Yes, Dubai’s real estate market is open to foreign investors. In 2002, the UAE government allowed foreigners to own freehold properties in designated areas, making it an attractive destination for international buyers. - What are the advantages of owning a freehold property in Dubai?

Owning a freehold property in Dubai provides full ownership rights, allowing investors to have complete control over the property. It also offers the potential for long-term capital appreciation and the freedom to lease, sell, or transfer the property without restrictions. - How can I verify the authenticity of a real estate broker in Dubai?

To verify the authenticity of a real estate broker in Dubai, you can check if they are registered with the Dubai Real Estate Regulatory Agency (RERA). RERA provides a list of licensed brokers on its official website, ensuring that you work with a reputable and authorized professional. - Are there any restrictions on selling a property in Dubai as a foreigner?

No, there are no restrictions on selling a property in Dubai as a foreigner. Investors of all nationalities can freely sell their properties without any nationality-based limitations. - What are the popular areas to invest in Dubai homes?Some popular areas to invest in Dubai homes include Downtown Dubai, Dubai Marina, Palm Jumeirah, Jumeirah Lakes Towers (JLT), Arabian Ranches, and Dubai Hills Estate, among others. These areas offer a mix of luxury and lifestyle amenities, making them attractive to both investors and residents.

- Does Dubai offer any incentives for real estate developers?

Yes, the Dubai government provides various incentives to real estate developers to promote sustainable development and innovation. These incentives may include tax benefits, access to financing, and simplified regulatory processes to encourage investment in the city’s real estate sector. - What is the process of obtaining a mortgage for a property in Dubai?

To obtain a mortgage for a property in Dubai, you will need to approach banks or financial institutions that offer mortgage services. The bank will assess your eligibility based on factors such as income, credit history, and the property’s value. Once approved, the bank will provide you with a mortgage to finance the property purchase. - Are there any upcoming mega-projects in Dubai’s real estate sector?

Dubai is known for its ambitious mega-projects that continuously shape its skyline. While specific projects may change over time, there are always new and exciting developments in the pipeline, driven by the city’s commitment to growth and progress. - Can expatriates lease property in Dubai for the long term?

Yes, expatriates can lease property in Dubai for the long term. Rental agreements typically last for one year, with the option to renew. Some landlords may also offer more extended lease terms for added convenience. - How does Dubai’s real estate market compare to other global cities?

Dubai’s real estate market is known for its dynamism, innovation, and grand scale of developments. It competes with other global cities, such as London, New York, and Singapore, attracting international investors with its unique lifestyle offerings and tax advantages.

Useful Links

- For information on real estate projects then please visit the Dubai Land Department.

- For a general guide about living in Dubai.

- More information about the Dubai Economy.

- If you are planning to visit then check the Dubai Visit Visa Entry Requirements.

- Check out the best beaches whilst you are here.

- The Dubai Marina is a great place to visit as well.

- You have to visit the Palm Jumeirah as well.

- For commercial office space, Business Bay is another location.

- Rent a car or a luxury car whilst in Dubai.

- If you’ve bought a house then consider leasing a car for the long term.

Key Takeaways

- Dubai’s real estate market offers a diverse range of residential properties to suit different preferences and budgets.

- Freehold and leasehold properties provide different ownership options for buyers in Dubai.

- The Real Estate Regulatory Authority (RERA) and Dubai Land Department (DLD) play essential roles in regulating and facilitating property transactions.

- Buyers and sellers must understand the legal procedures, costs, and documentation involved in property transactions in Dubai.

- Prominent property developers have shaped Dubai’s skyline with iconic projects.

- Real estate brokers act as intermediaries, assisting buyers and sellers in achieving their objectives.

- Dubai’s real estate market operates under a robust legal framework, ensuring the rights and protection of stakeholders.

- The city’s real estate history is a testament to its remarkable transformation over the years.

- Trends in sustainable practices and smart technologies are prevalent in Dubai’s real estate sector.

- While opportunities abound, investors must also be aware of challenges in the market.